- Mutual Fund Interest Rates Today

- Edward Jones Cd Rates 3/19/2019

- Edward Jones Rate Of Return

- Edward Jones Cd Rates April 2019

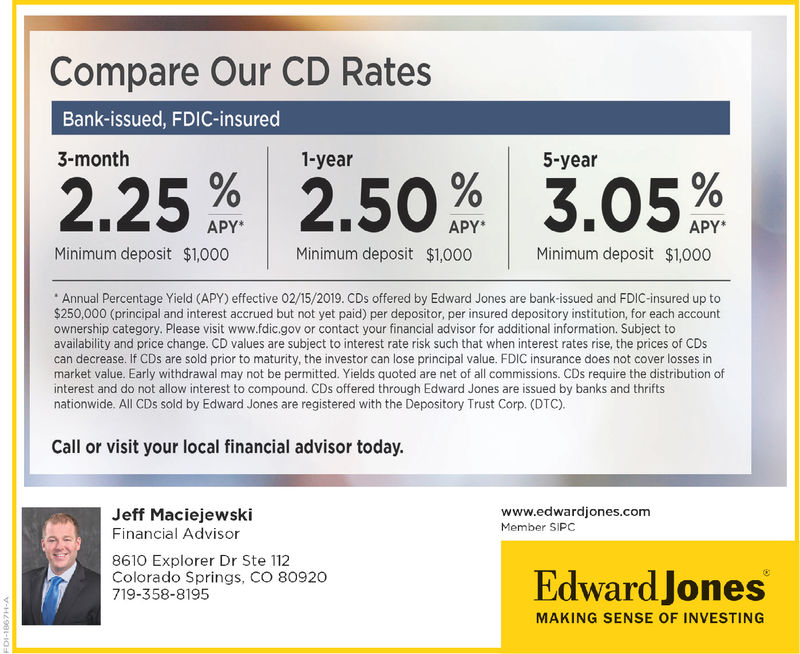

Edward Jones commission schedule, fee structure for 2021. Investing annual management rates, account transaction cost, advisor compensation. CD terms range from 3 months up to 10 years with deposit minimums $1000 for all term types. Please check with Edward Jones for availability in your state. At Edward Jones you can build a CD ladder so as a CD matures and you can buy the next rung on your ladder with local financial advisers available to help with a EJ laddering strategy. Find the best CD rates by comparing national and local rates. A Certificate of Deposit is a type of savings account that has a set interest rate and withdrawal date. Typically, CD interest rates. After you log in to Edward Jones Online Account Access, look for: The small, locked padlock on your web browser (most likely near the address bar). This indicates TLS technology is used. 'at the beginning of the website address, or URL. The 's' means you're on a secure site.

Edward Jones is a brokerage firm you’ve probably heard of over the years as it nears almost a century in age.

Founded in 1922, Edward Jones scores surprisingly well in customer satisfaction—18 points over the industry average, according to a J.D. Power 2019 survey—and is known for being a largely reliable and professional company.

The current suite of brokered certificates of deposit offered through Edward Jones are, for the most part, less competitive than the current national average for their respective terms. Other than perhaps the 10 year CD currently offered through Edward Jones, higher yields can be found directly through online banks and credit unions.

Because Edward Jones is a brokerage firm and not an actual bank they don’t sell their own CDs. Instead, they ‘broker’ or re-sell a range of deposits from other banking institutions.

Are Edward Jones brokered deposits worth considering? Read our full review below.

[Update March 2021]: Edward Jones longer term brokered CD Rates (5 year + terms) continue their slow move upward as bond and treasury yields do the same. Their APYs are now competitive with some of the better offers we see from credit unions and online banks. Their short term yields remain uncompetitive.

Other than the current trend of rising yields for longer terms, brokered CDs have some additional noteworthy features.

For one, you can exit these CDs at any time by selling them through a secondary market which Edward Jones offers. Second, you can spread your funds into multiple banks with Edward Jones as your broker.

Edward Jones CD Rates

All Edward Jones CDs require minimum opening deposits of $1,000. Please note that 3 and 9 month CDs as well as 4 and 7 year CDs are not available at this time.

Mutual Fund Interest Rates Today

To give these offers some context, the current national average for a 12 month CD and a 60 month CD sit at 0.14% APY and 0.31% APY, respectively, according to recent FDIC data.

If you’re looking for FDIC-insured alternatives that don’t require you to lock up your money for a predetermined period of time, there are still a handful of online savings accounts providing yields above 0.50% APY. For example, the Axos High Yield Savings account still holds an APY of 0.61%!

Edward Jones Brokered CDs Account Details

A few crucial distinctions must be made between standard CDs and Edward Jones’s brokered CDs.

The most important of these being that you do not open or manage brokered CDs yourself. On top of that, the actual CD isn’t technically a product of Edward Jones at all. Instead Edward Jones purchases a CD for you from one or many different banks in partnership with this firm.

You can open new CDs with Edward Jones or you can purchase secondary CDs.

If you open a new CD with Edward Jones you will not have to pay any commission fees. Edward Jones will receive a concession from the bank that takes your deposit, but this is already factored into the price.

If purchasing a CD on the secondary market, you will have to pay Edward Jones a commission just like you would purchasing stock. You can see what commission they take in the trade confirmation.

A benefit of Edward Jones brokered CDs is that they don’t have early withdrawal penalties. If you need to cash out of your deposit early you can simply sell it to another investor on the secondary market.

Edward Jones Cd Rates 3/19/2019

Unfortunately, this also means there is an inherent downside to these products in that their price fluctuates on the open market and can feasibly be sold for less than the purchase price.

For example, if you open a 5 year deposit and need the funds after year 2, during which time interest rates have risen considerably, you may have a tough time selling your deposit for your full purchase price.

Conversely, if you purchase a 5 year deposit and rates drop significantly (which they have) then you may find investors willing to offer a premium on your CD on the secondary market.

Also note, interest earned on Edward Jones CDs does not compound. This is true of most brokered CDs as they require an immediate distribution of interest. The terms of your personal CD will tell you how often the interest on your account is credited and where.

Brokered CDs with Edward Jones do not automatically renew.

:format(jpeg):mode_rgb():quality(90)/discogs-images/A-294163-1260742711.jpeg.jpg)

To open a brokered CD with Edward Jones, you’ll first need to set up a brokerage account with them if you don’t have one already. Edward Jones is a full service brokerage account with no minimum deposit requirements for account opening.

Opening up an Edward Jones brokerage account can be done online, however purchasing an Edward Jones brokered CD can not. For this you will have to go to a local office and fill out the paperwork. They will provide you with a prospectus to look over and discuss your options with you before you make any decisions.

Edward Jones Rate Of Return

As soon as your initial deposit clears, you are free to buy a new CD or a secondary CD through your Edward Jones broker.

Edward Jones is a member of SIPC and deposit products with this firm are insured up to $250,000 per depositor.

In addition to its extensive suite of investment products and brokered CDs, this firm also offers money market funds and a cash management account.

Edward Jones Money Market Funds

Money market funds offered at Edward Jones, and most other brokerage firms, are not money market accounts. Money market funds are simply liquid mutual funds with good cash access. Money market accounts are federally insured deposit accounts with a guaranteed return of principal plus accrued interest.

Because money market funds are mutual funds with cash access, they do not guarantee that you will receive a full return on your principal.

On top of that, the cash in a money market fund may be used to invest in CDs or other short-term investments, but deposits into these funds are not FDIC insured.

Edward Jones money market funds are available as investment shares and retirement shares – both of these taxable options. You will be charged a $3 monthly maintenance fee for retirement share class money market funds with balances below $1,500 and a $3 monthly maintenance fee for investment share class money market funds with balances below $2,500. Talk with your advisor about cash and cash equivalents available for you to invest in with your money market fund—this will vary.

There is no minimum investment required to open a money market fund and the current 7-day yield per share is 0.01%.

Edward Jones Cd Rates April 2019

On the positive side, these money market funds make withdrawing and using money simple because they allow you to write unlimited checks and use a Visa debit card. Transactions and withdrawals are unlimited, unlike money market accounts.

Edward Jones Flex Funds Account (Cash Management Account)

An Edward Jones Flex Funds account is a cash management account that earns interest on your uninvested balance.

There is no annual fee and you can write up to 120 checks per year free of charge. This account is insured up to $1.5 million leveraging multiple banks’ $250,000 FDIC deposit insurance using the “Bank Sweep Program.”

With a Flex Funds account, you can set short-term savings goals for yourself and easily track your progress toward them. Your financial advisor can go through the details about how to strategize saving and investing with this account, but you have a lot of options and flexibility overall with a product like this.

Account Set-Up and Management

Edward Jones allows you to make quick and easy deposits into your account(s) and transfer funds electronically. You can enroll in online bill pay and link a direct deposit to one or more of your savings or investment accounts. Mobile check deposit is another feature included on the Edward Jones native apps for both Google Play and App Store. Though poorly rated, the apps are comprehensive and functional.

Edward Jones is a more than satisfactory brokerage firm and its brokered certificates of deposit are [finally] offering some competitive APYs for longer maturities.

As treasury yields slowly climb upward, we expect Edward Jones brokered CD rates to continue their ascent as well.

The Annuity Man® has developed a proprietary tool that allows you to shop for the best MYGA rates in the country and your specific state of residence.

With our live feed of the best MYGA rates, you can now shop for annuities online to find the best annuity rate that fits your financial situation and goals before you decide to purchase an annuity.

Multi-Year Guarantee Annuities (MYGAs) are also called fixed-rate annuities and are a specific annuity product type that functions similarly to a CD (Certificate of Deposit).

Both MYGAs and CDs contractually guarantee an annual interest rate for a specified period, have no annual fees and are fully principal protected.

Some of the key features and benefits that MYGAs contractually offer are listed below.

- No annual fees

- Contractually guaranteed annual interest rate

- Tax-deferred growth in non-IRA accounts

- Rates are typically higher than CDs

- Interest compounds tax-deferred in a non-IRA account

- Can be purchased inside of an IRA or non-IRA account

- Easy to understand

- No moving parts or market attachments

- Can be laddered like CDs and Bonds

- Full principal protection

- Can be transferred to another MYGA without tax consequences

Multi-Year Guarantee Annuities (MYGAs) are the annuity industry’s version of a CD (Certificate of Deposit). Both MYGAs and CDs allow you to contractually lock in a specific annual interest rate for a duration of time you choose at the time of application. MYGAs can be as short term as 2 years and you can lock them in for as long as 20 years. MYGAs have no annual fees, no moving parts, and provide full principal protection while guaranteeing an annual interest rate. If you are a current CD buyer, then you should also be a MYGA buyer.

The primary difference between a MYGA (i.e. annuity contract) and a CD is that in a non-IRA (i.e. non-qualified) account, the MYGA interest grows tax-deferred with no tax penalty on the interest earned. With CDs in a non-IRA account, you must pay taxes annually on that guaranteed interest rate that is credited. This tax-deferral benefit does not make MYGAs better than CDs, it is just the primary contractual difference between the two strategies. MYGAs can also be transferred from one MYGA to another in a non-IRA account, without creating any tax consequences. In other words, that annuity to annuity transfer would be a non-taxable event using the IRS approved 1035 exchange rule. MYGAs inside of an IRA can also be transferred via a non-taxable event as well. That would be an IRA to IRA transfer and would not trigger any taxes.

After the surrender charge period ends, you can also transfer a MYGA to another type of annuity as well. For example, you can transfer the full MYGA proceeds to a SPIA (Single Premium Immediate Annuity) if you need income to start now. Another example would be to transfer your MYGA to a DIA (Deferred Income Annuity) if you need income guarantees to start at a future date. In each case, the initial cost basis would transfer to the receiving annuity strategy...and that transfer would be a non-taxable event as well.

The other difference between MYGAs and CDs is the backing or insurance behind the product. MYGAs are fixed annuities that are issued by life insurance companies and regulated at the state level. Each state has its own State Guaranty Fund that backs MYGAs to a specific dollar amount. Each state has different coverage, so go to www.nolhga.com to check your specific state of residence coverage. CDs are FDIC insured. The Federal Deposit Insurance Corporation (FDIC) is superior coverage, in my opinion, when compared to State Guaranty Funds.

MYGAs and CDs can work well together to create a fixed rate ladder strategy. Historically, we have found that MYGAs provide higher rates than CDs if the contracted term is 3 years or more. For less than 3-year time periods, CDs typically provide the highest annual rates. With most MYGAs, you can choose to peel off the interest penalty-free. Peeling off the interest is not considered “partial withdrawals” because the principal is never touched. If you do decide to dip into the principal, there will be surrender charges during the specific locked-in period. This interest only strategy can be part of your retirement income plan, in combination with Social Security, pensions, etc.

MYGAs can be set up with one owner, or with joint ownership. Also, the listed beneficiaries on the policy can be changed by the owner(s) at any time as long as they are alive. In other words, your policy beneficiaries are revocable...not irrevocable. That is important if your beneficiary listings need to be changed or updated.

If you are a current CD buyer, then you need to consider adding MYGAs to your principal protected fixed-rate portfolio. It is important to consider the MYGA company’s claims-paying ability before making your final decision. On our site, we offer a free download of a monthly CANNEX report that shows all 4 rating services (A.M. Best, Moody’s, S&P, Fitch) and an easy to understand 1 to 100 score for each life insurance company (i.e. MYGA carrier) in the United States.

Before you purchase a MYGA, you need to read my MYGA Owner’s Manual and speak with me personally before you make a decision. We have a live feed of the best MYGA rates that you can look at and shop around without having to sign up. Most MYGAs allow you to peel off the interest penalty-free, but not ALL do. On our live feed, we will show you the MYGA carriers that allow or do not allow interest to be taken out. I encourage you to take a look at the best rates and terms for your state of residence and then schedule a call with Stan The Annuity Man® to have a full conversation about MYGAs.

There is never an urgency to buy a MYGA (or any annuity for that matter), the only urgency is to fully understand the benefits and limitations of the MYGA you are specifically considering.